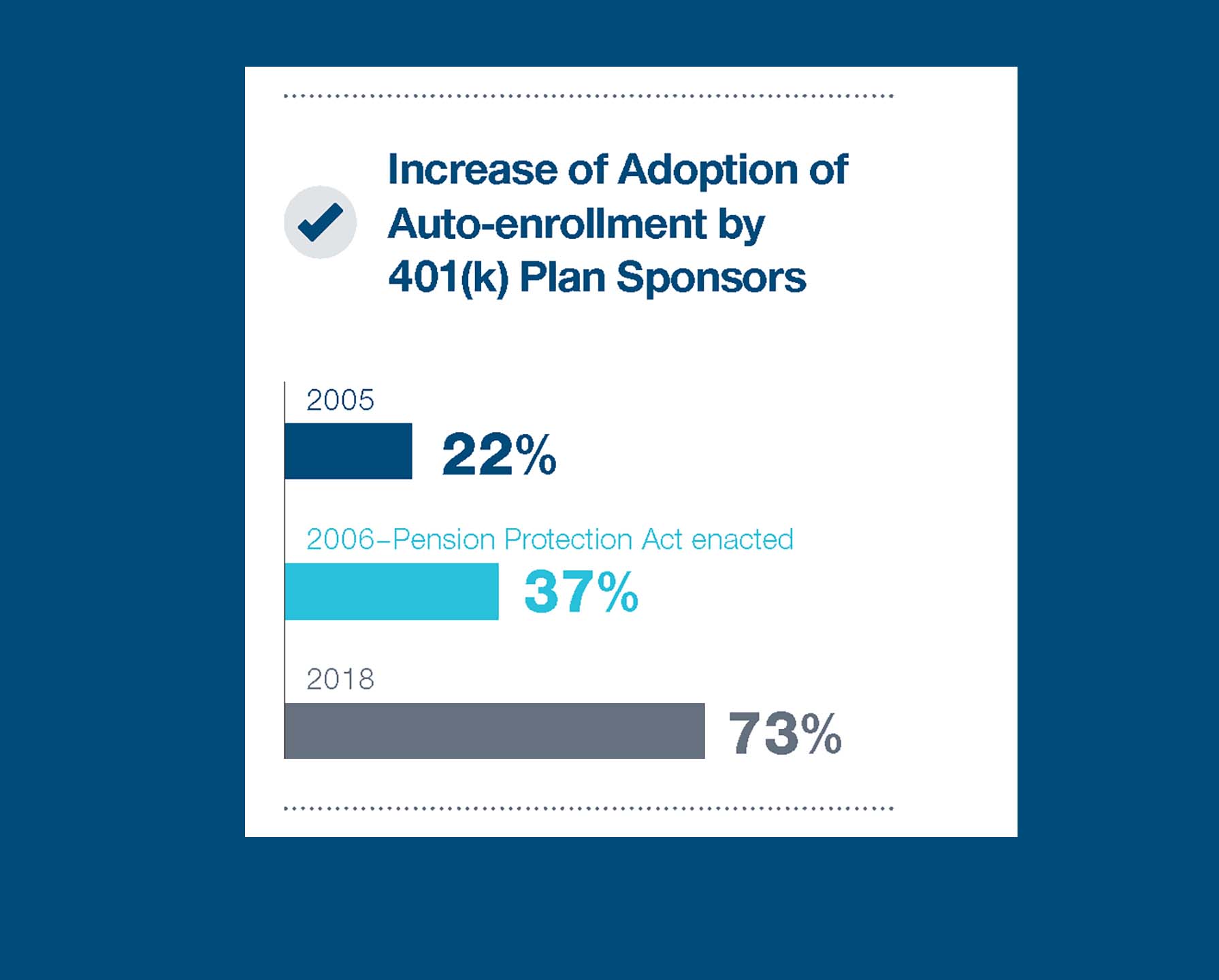

Lately we have fielded many questions related to 401(k) auto-enrollment. Plan sponsors seem split on the idea of being paternalistic or letting participants decide for themselves whether to take advantage of their full suite of employee benefits. Although the adoption of auto-enrollment is on the rise, the answer is not the same for all plans. Below, are some pros and cons, and potential pitfalls of auto-enrollment.

The Good:

- With auto-enrollment, employees are automatically saving for their futures unless they “opt out.” Most employees will not feel a 5% reduction in wages, especially since they are paying themselves.

- Creating an auto-enrollment plan for all new employees is a terrific way to increase the participation rate and to obtain more engagement.

- If your company offers matching contributions, auto-enrolling employees will help ensure they max out this benefit. Make sure that the plan’s default deferral percentage covers the maximum matching contribution. The matching contributions can be seen as “free money” and is a great incentive to offer new hires.

- Employees contribute pre-tax dollars in 401(k) plans. This means that their taxes are deferred, and they will not pay income tax until withdrawals are made in the future. Participating employees pay less tax now, and once they retire, they usually are in a lower tax bracket.

- Without auto-enrollment, variations in contribution rates can be large among different demographics. This could result in failed discrimination testing. However, with auto-enrollment, corrective action for failed discrimination testing is less likely since participation is generally more broad based.

The Bad:

- Most companies that auto-enroll their employees do not provide detailed information on how much they should save for retirement and how to invest. Scheduling time with employees on a regular basis to discuss their future cash needs and reviewing their retirement portfolio would be valuable for participants. There are many means of providing participant education, including on-line, videos, one-on-one, etc. Adequately educated participants should be more productive and have higher morale, all else equal.

- Some companies do not notify their new/existing employees about auto-enrollment or make details about the program clear. Employees may be surprised when they see a larger payroll deduction than anticipated, which could lead to feelings of mistrust. If your company does end up utilizing the auto-enrollment policy, make sure employees understand that they have the option to opt out (even if it is not in their best interest).

The Ugly

- Employees who withdraw from their 401(k) before turning 59½ will face early withdrawal fees if they do not roll the full plan into another 401(k) plan or an IRA Rollover. Any portion that is not rolled over, will face a 10% penalty, plus the money will be considered ordinary income and taxed at the normal income tax rate. If any employees wish to withdraw money early, you need to make sure they fully understand the consequences.

- Due diligence is extremely important in choosing which 401(k) plans to use for your company. 401(k) plans all have different administration fees, and some can be much higher (compared to the industry average). If the funds that are available to employees in the plan also have a high expense ratio, employees could be losing out on substantial returns based on high fees alone.

Auto-enrollment can be beneficial for employees and employers at the same time. Auto-enrollment can increase engagement in the 401(k) plan while also increasing the retirement wealth of individuals who were not previously participating. Properly rolled out, auto-enrollment can become an effective tool for your company and your employees. If you have any questions about auto-enrollment in 401(k) plans and how it may impact your plan, please contact us.